|

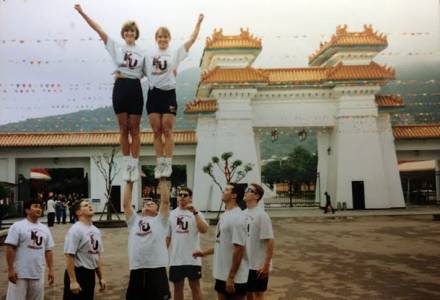

Spurred by a growing demand for urban core living, there are about 1,800 multifamily units in the works around Downtown San Antonio. That's why we're excited to bring you Bisnow's 4th annual San Antonio Multifamily Summit on March 26 at the Sheraton Gunter San Antonio.  Among the projects in the works is Hemisfair. The home of the 1968 World Fair hopes to see its rebirth as a vertical mixed-use project around the Henry B. Gonzalez Convention Center and Tower of the Americas, says Hemisfair director Omar Gonzalez. The master plan includes multifamily, office, hotel, parking and ground-floor retail—RFQs were issued today for developers to join a public-private partnership to build along South Alamo and Market streets. Omar (center, between Hemisfair CEO Andres Andujar and senior PM Gary Boyd on a scouting trip to Seattle to tour their conversion of its 1962 World's Fair to a public park, Seattle Center) anticipates 500k to 750k SF of development, with the majority of that focused on multifamily. That's just one phase of the 37-acre site, which is a few blocks from the Riverwalk and the Alamo.  A master plan for the project was created in 2012 with about 18 acres dedicated to parks and 14 acres to new development, Omar tells us. (The remaining five acres is rights of way.) The Hemisfair area was a vibrant neighborhood prior to the '68 Fair with hundreds of residents. The idea is to make this into a neighborhood again and form a community here, Omar says. The most important piece is the residential, but given the demands of downtown, the project has to be dense, he says. Omar predicts Hemisfair could be home to about 2,000 units (about 3,500 residents). The first phase of the master plan calls for using about four acres on a six-acre site to develop a play area for all ages and abilities. HPARC is already in negotiations with a multifamily developer for a 160-unit P3 project with 400-car garage, including public parking for park goers.  The two hot spots for multifamily construction are around downtown and Southtown, says JLL managing director Scott LaMontagne (here, with his wife on New Year's Eve). There are 1,809 units under construction around the urban core with density playing a big role, Scott says. The backstory: Broadway created 2,000 units in the last two years that poured into the market all at once. Given the strong lease-up momentum and ability of those assets to raise rents, burgeoning retail has followed. The Broadway corridor success spurred people to believe in developing higher density and the ability to get the rent structures needed to support it. Now, Scott says, the area is getting close to reaching a critical mass on the urban residential front.  JLL has a 3.3-acre (full city block) site in downtown San Antonio under agreement right now for a high-density multifamily project, Scott tells us. It's walking distance from Hemisfair and the new HEB grocery store. Other new construction around downtown includes an Amstar/Transwestern deal in Southtown, the Peanut Factory Lofts (pictured), Agave Riverwalk, a Greystar project, River House, the Cellars at Pearl, Rivieria, Blue Star Lofts second phase and McCullough Lofts, among others. The demand for all of this new product isn't because of downtown jobs, it's more the desire to live in an area with a high walkability score in an urban environment. That national trend has finally made its way to San Antonio, Scott tells us.  JLL has 12 proposals in San Antonio and another half-dozen just about ready to go. Scott and his team have four A-class listings, which include the Peanut Factory Lofts, which has already won accolades for its adaptive reuse of an old peanut factory downtown and the 328-unit Silver Rock in northwest San Antonio, both in pre-launch, in addition to Barcelona Lofts and Parway Falls, which are on the market. Scott says transaction velocity slowed through the winter, but he thinks it will pick up this spring. Here's Scott in Taiwan in 1995 holding up two cheerleaders. He was the head cheer coach at KU from 1991 to 1995; this shot was taken after the squad won the national championship and was asked to come perform in Taiwan. '80s- and '90s-vintage communities are getting record low cap rates in San Antonio, ARA principal Pat Jones (another panelist) tells us. (Of course, value-add investors are typically five-year IRR buyers and aren't driven by cap rates.) The largest pools of capital are earmarked for these older properties. Pat's team has sold 1,100 value-add units in San Antonio's Medical Center area in the last 45 days, and Pat tells us each community (Signature Ridge and Promontory Pointe) topped 20 tours and got around 10 offers, and each closed in the mid-to-high 5% cap rate range. ARA has two older vintage properties on the market now: Park at Walkers Ranch (pictured) and Amesbury at Deerfield. They might get even more activity than the Medical Center assets; Pat says dropping oil prices have increased investor attention in Central Texas. (Groups that had been targeting Houston are now focusing on San Antonio and Austin.)

|

|

|

|

|

Pearl Breaks Ground in AustinMorgan broke ground on Pearl Lantana, a 444-unit luxury apartment project in southwest Austin. It'll be particularly attractive to tech employees working just down the road for AMD, Solar Winds and Freescale, and has easy access into Downtown. It'll also suit outdoors lovers, with its park-like design and connection to the greenbelt and trail systems. Financed by US Bank, Pearl Lantana's slated to deliver in Q4 '16. The property is along Southwest Parkway at 4601 Rialto. |

|

|

Come Hear about San Antonio's Multifamily BoomThere's new development and transactions on the rise and that's why we're excited to bring you Bisnow's 4th annual San Antonio Multifamily Summit on March 26 (7:30am start) at the Sheraton Gunter San Antonio. We'll learn about the latest deals and who's building where as well as the resurgence of condos. Among the star-studded panelist are USAA's Hailey Ghalib, Lynd's Mike Lynd Jr and Embrey Partners' Robert Hunt. Save your place here. |

|

|

Doing Retail Business in DC, Maryland, Virginia?Headed to ICSC's annual expo in Las Vegas this spring? If so, we hope you'll join our party for the Metro Washington DC region at the Wynn Hotel's incomparable Tryst Nightclub from 5:30 to 8:00 PM on May 18. We're honored to announce that our supporting firms include these top retail players of the DC region: Founding Partners Presenting Sponsors Founding Sponsors More information? Please check out our event page, or contact Chris.Wainwright@Bisnow.com |

|

Negotiating Guidance

|

|